7.15.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 7/15/2020 at 3 PM.

LTL

YRC Worldwide (NASDAQ: YRCW) announced it expects to receive a $700 million loan from the United States Department of the Treasury under the CARES Act.

The less-than-truckload (LTL) carrier has been facing mounting financial pressure amid the pandemic to fund obligations to its 30,000 employees. The company is delinquent in making health and welfare as well as pension payments to funds that support its union and non-union employees.

The press release said the company plans to use the money to make the deferred benefits payments to satisfy their obligations.

“We would like to thank Congress for passing the CARES Act and the U.S. Department of the Treasury for providing this vital funding which recognizes the essential role YRCW plays in the nation’s supply chain. Through our work with over 200,000 customers, including being a leading transportation provider for the Departments of Defense, Energy, Homeland Security, and Customs and Border Protection, YRCW’s freight professionals have developed a deep understanding of, and expertise in, the importance of a secure and reliable supply chain,” said YRC CEO Darren Hawkins.

Learn more here.

Truckload:

A slight uptick in TL activity the week of July 10: An overall slow first half of July as compared to the end of Q2. Total spot load postings in the Truckstop.com system rose more than 17% during the week ended July 10 (week 27), but volume did not quite rebound to week 25 levels. Weak loads on the Monday following the weekend Independence Day holiday muted week 27 gains. Loads in all key segments – dry van, flatbed, and refrigerated – were higher than in week 26, but rates excluding fuel surcharges were lower in all segments for the first week-over-week decline in total rates since the bottom in week 16.

Learn more here.

Carrier Capacity

Carriers’ reluctance to add capacity, after being burned badly after failing to remove capacity following the plunge in volumes triggered by the 2008-09 financial crisis, is understandable. The capacity discipline that has allowed container lines to keep spot rates elevated on major trades despite falling volumes, raising the chances of the industry ending the year in the black, is beginning to draw a backlash.

Given that they “have done well in a pandemic,” Drewry Shipping Consultants wondered in a July 6 report whether carriers are profiteering from the disruption caused by the coronavirus disease 2019 (COVID-19). The consultancy, in the report titled “When big profits look bad,” also asked what can be done to smooth tensions between carriers and shippers. “The current situation — higher carrier profits, but no service improvements — should be a reason for concern for competition authorities,” Olaf Merk, of the International Trade Forum, said in an interview with www.JOC.com.

Payroll Protection Program (PPP) loans

According to JOC.com, US Small Business Administration data show the PPP program is maintaining approximately 479,000 for-hire trucking jobs. Approximately 30 percent, perhaps more, of US for-hire trucking jobs are being supported by government loans, according to data released this week by the US Small Business Administration (SBA) about companies that received Payroll Protection Program (PPP) loans. That alone indicates the PPP loans may have prevented a trucking capacity crunch in June by keeping a large number of truck drivers paid, if not always behind the wheel, when freight demand plummeted during the COVID-19-linked business shutdowns of April and May. It also demonstrates the importance of the PPP program, which has been extended through Aug. 8, to maintain an adequate supply of trucks for shippers during an economic recovery that is more likely to stutter than roar, as the COVID-19 pandemic continues to spread.

eCommerce:

Amazon will restrict warehousing space, with peak season looming, Amazon will restrict warehouse space based on inventory productivity for third-party sellers using Amazon's fulfillment services starting Aug. 16, the company told sellers in a notice Monday.

Peak season 2020 may be tepid in terms of total sales, but e-commerce heavy-hitters need to be prepared for record volume, as coronavirus cases are climbing again and some states are reversing earlier moves to open up their economies. Amazon has already learned this year what such spikes in order volume can do to its industry-leading supply chain.

After restricting incoming inventory to essential products due to capacity constraints in the early weeks of the pandemic in the U.S. Amazon is attempting to avoid a replay with these changes to FBA standards, according to Rick Watson, founder and CEO of RMW Commerce Consulting.

Learn more here

And don’t forget to claim your spot for our upcoming webinar: KPIs for Supply Chain Performance!

Please contact us directly with any questions. Our next update will be no later than Wednesday, 7/15 at 4 PM. Please visit our website for other updates.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

6.30.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 6/30/2020 at 3 PM.

Parcel:

On-time performance falls: In May, FedEx and UPS on-time performance dropped to their lowest monthly averages so far in 2020, according to numbers from ShipMatrix and Convey, though the magnitude of the decline varies greatly between the two sources. UPS said it did not comment on third-party data sources, but directed Supply Chain Dive to ShipMatrix's figures when asked about the accuracy of Convey's numbers. Learn more here.

Air:

FEMA winds down PPE Flights: Air Freight rates from China and Hong Kong to the U.S. have fallen nearly 50% from their peak in mid-May, Maayan Citron, the head of corporate marketing at Freightos, told Supply Chain Dive in an email. Falling demand for shipping PPE via air is an important factor in the falling rates. "Most areas have been able to build up inventories of PPE, and can now use the ocean to ship parts of the ongoing demand," Citron said. Learn more here.

General Updates:

Demand for warehousing space will rise: The shift from brick-and-mortar to e-commerce operations is expected to intensify as a result of the coronavirus pandemic, which will likely cause greater investment in warehouse space because e-commerce requires three times the logistics space of traditional storefronts, according to a new report from Prologis.

"Online order fulfillment requires more logistics space because 100% of inventory is stored within a warehouse (vs. store shelves), which allows for greater product variety, deeper inventory levels, space-intensive parcel shipping operations, and additional value-add activities such as processing returns," the report reads. Learn more here.

Diesel price creeps up: The national average retail price of diesel rose for the fourth consecutive week, half of a penny to $2.43 a gallon, according to data the Energy Information Administration released June 29. Even with the increase from $2.425 the price of trucking’s primary fuel is 61.2 cents a gallon less than it was a year ago. Learn more here.

Other National Updates:

State of the States: Learn about any updates from the states. Find out more about each state here.

We are excited to announce that Jarrett has been awarded a Top Workplaces 2020 honor by The Plain Dealer. The list is based solely on employee feedback gathered through a third-party survey administered by employee engagement technology partner Energage, LLC. The anonymous survey uniquely measures 15 drivers of engaged cultures that are critical to the success of any organization: including alignment, execution, and connection, just to name a few. Learn more by visiting our website.

And don’t forget to claim your spot for our upcoming webinar: KPIs for Supply Chain Performance!

Please contact us directly with any questions. Our next update will be no later than Wednesday, 7/15 at 4 PM. Please visit our website for other updates.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

6.17.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 6/17/2020 at 3 PM.

LTL:

Freight volumes heat up: Trucking volumes are heating up as we enter the heat of the summer. As the country continues to wrestle with COVID-19, the steady rise in volumes has become a positive sign that freight is recovering. This is much to the delight of less-than-truckload (LTL) carriers, as many have struggled to stay afloat amid the pandemic. Read more here.

E-commerce aiding LTL carriers: The $46 billion-a-year less-than-truckload (LTL) sector is faring relatively well economically during the downturn in freight demand as a result of closures associated with the COVID-19 pandemic. “The publicly held LTL carriers have shown a continued ability to achieve rate increases even in light of lower demand,” Satish Jindel, president of SJ Consulting, told LM. “Their pricing has stayed consistent.” Find out more here.

TL:

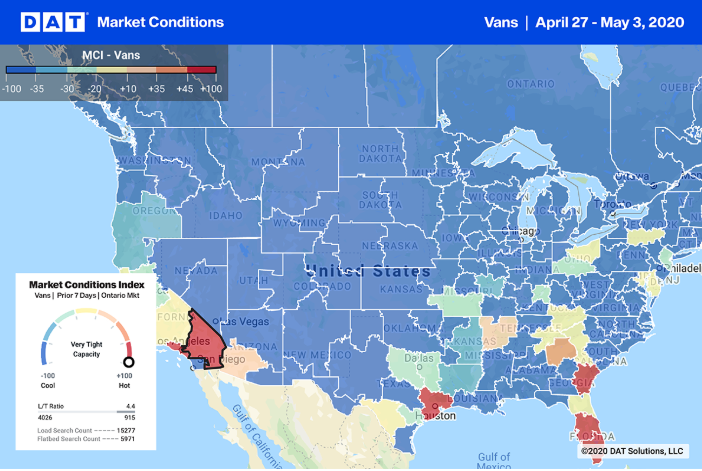

Truckload markets in recovery: Check out the market updates according to DAT here.

U.S truck spot rates likely to flatten: According to JOC.com, Truck rates rose rapidly in early June, but are approaching a “plateau”, DAT Solutions said in the article published June 16. Business reopening’s and produce harvests are pumping more freight into the US truckload spot market, raising spot rates from low points hit in April and May. However, that does not necessarily signal a ‘V-shaped’ recovery from the recession. Spot rates are likely to flatten or drop in seasonal fashion after the Fourth of July holiday, said Ken Adamo, chief of analytics at DAT Solutions.

“I do think our modeling is bearing out that the spot market should slow down considerably post- Fourth of July,” Adamo told JOC.com Tuesday. June typically is the busiest month of the second quarter for truckers and the height of the spring and summer retail season. Freight volumes typically are soft in July and the “dog days” of August, Adamo pointed out.

Other National Updates:

State of the States: Learn about any updates from the states. Find out more about each state here.

Join us tomorrow! Join Matt Wagner, Vice President Sales & Marketing, and myself, in a 3 part webinar series that discusses continuous improvement within supply chain management. Whether you are considered Beginner, Intermediate, Advanced or World-Class there is always room to strive for improvement.

On Thursday, June 18 at 11:00 AM EST, Matt and I will discuss the outbound order flow process in the series consisting of Order Entry, Quoting & Optimization, Customer Markup, Shipment Document Creation, Load Tendering, Tracking & Visibility, Freight Bill Audit, Carrier Payment and Building the Data Warehouse. What’s the next step in your journey toward continuous improvement and how do you plan to get there? Register now!

Please contact me directly with any questions. Our next email update will be no later than Tuesday, 6/30 at 4 PM. Please visit our website for other updates.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

6.10.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 6/10/2020 at 3 PM.

LTL:

US LTL carriers see gradual improvement in dismal May: According to JOC.com, US industrial freight demand improved in May from April as economic activity slowly began to revive after a widespread shutdown of businesses in March and April, according to mid-quarter reports from less-than-truckload (LTL) carriers Old Dominion Freight Line (ODFL) and Saia.

For the month, however, ODFL’s revenue per day dropped 16.2 percent year over year as LTL shipments per day decreased 16.7 percent, a measure of the broad and deep damage caused by the COVID-19 pandemic and recession. In April, volume was down nearly 20 percent.

Multiregional LTL carrier Saia reported a similar trend. The eighth-largest US LTL carrier said shipment volumes were down 16.2 percent year over year in April but 9.2 percent in May. That suggests LTL freight volumes are getting “less worse” as the US takes first steps toward economic recovery and some factories and businesses come back online. A broader picture will emerge as more public companies report on mid-second-quarter conditions.

FMCSA HOS exemptions: The Federal Motor Carrier Safety Administration (FMCSA) has extended its national emergency exemption for hours of service (HOS) to July 14 but has excluded grocery restocking, fuel, and precursor raw materials from the extension. Find out more here.

TL:

Truckload activity: According to DAT, Spot Market TL activity was up 10% in May, due to both the reopening of the economy and produce season. However, “The trucking market is moving up in a slow, stair-step manner,” FTR Transportation Intelligence said in its latest Trucking Recovery Index report Monday. Despite May’s improvement, freight demand “still remains below ‘normal’ levels.”

Other National Updates:

Air Freight capacity falls: Air Freight capacity falls 42%, ‘damaging’ global supply chains. Air Freight rates have started to fall from their peak in mid-May but are still well above the rates seen in early March when prices began to climb. Find out more here.

Amazon Air’s fleet expansion: Amazon Air is adding capacity to its fleet by leasing 12 Boeing 767-300 converted cargo aircraft from Air Transport Services Group, the company announced Wednesday. The new planes will bring the company's fleet to 82 planes by the end of next year, five years after announcing its first aircraft. Find out more here.

State of the States: Learn about any updates from the states. Find out more about each state here.

Join us tomorrow! Join Matt Wagner, Vice President Sales & Marketing, and myself, in a 3 part webinar series that discusses continuous improvement within supply chain management. Whether you are considered Beginner, Intermediate, Advanced or World-Class there is always room to strive for improvement.

On Thursday, June 11 at 11:00 AM EST, Matt and I will discuss the outbound order flow process in the series consisting of Order Entry, Quoting & Optimization, Customer Markup, Shipment Document Creation, Load Tendering, Tracking & Visibility, Freight Bill Audit, Carrier Payment and Building the Data Warehouse. What’s the next step in your journey toward continuous improvement and how do you plan to get there? Register now!

Save the Date:

Part 3: Thursday, June 18, 2020 at 11:00 AM EST | Register now!

Please contact us directly with any questions. Our next update will be no later than Wednesday, 6/17 at 4 PM. Please visit our website for other updates.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

6.3.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 6/3/2020 at 3 PM.

LTL:

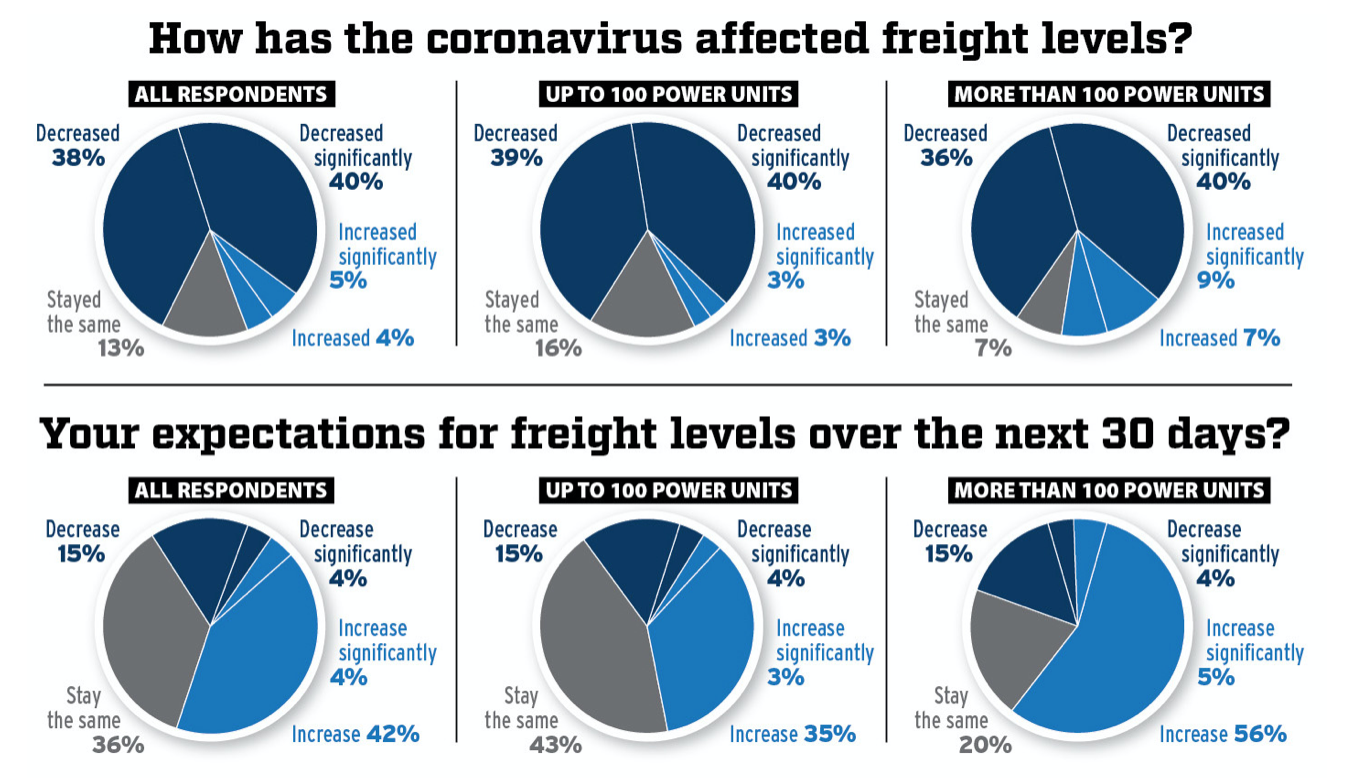

Carrier Optimism Soars: A CCJ survey conducted of 168 fleets ranging in size from 10 trucks to those with more than 1,000 shows true optimism for freight demand for the first time since CCJ began surveying carriers about COVID-19 and its impact on fleet operations. Nearly half of carriers surveyed, 46%, say they anticipate freight volumes to climb in the coming 30 days. Find out more here.

General National Updates:

State of the States: Learn about any updates from the states. Find out more about each state here.

Join us tomorrow! Join Matt Wagner, Vice President Sales & Marketing, in a 3 part webinar series that discusses continuous improvement within supply chain management. Whether you are considered Beginner, Intermediate, Advanced or World-Class there is always room to strive for improvement.

On Thursday, June 4 at 11:00 AM EST, Matt will discuss the outbound order flow process in the series consisting of Order Entry, Quoting & Optimization, Customer Markup, Shipment Document Creation, Load Tendering, Tracking & Visibility, Freight Bill Audit, Carrier Payment and Building the Data Warehouse. What’s the next step in your journey toward continuous improvement and how do you plan to get there? Register now!

Save the Date:

Part 2: Thursday, June 11, 2020 at 11:00 AM EST | Register Now!

Part 3: Thursday, June 18, 2020 at 11:00 AM EST | Register now!

Please contact us directly with any questions. Our next update will be no later than Wednesday, 6/10 at 4 PM.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

5.28.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 5/28/2020 at 3 PM.

TL:

Truck movement increases: Data from FourKites reflects what many industry researchers have observed and predicted: The trucking market has hit the bottom, and a gradual return, although asymmetrical by industry and geography, is in the cards.

To date, the biggest movement increases are in consumer-facing and essential industries. Volumes in food and beverage, CPG and retail are up by 5% to 10%, but manufacturing is up only marginally, according to Glenn Koepke, VP of network enablement.

Inbound and outbound truck movement is beginning to rise across most of the U.S., FourKites data shows. "Volumes are generally up" after hitting a floor during the week of April 27. Find out more here.

April tonnage down: April for-hire seasonally adjusted truck tonnage had the worst month since April 1994, falling 12.2% from March. The index was also down 11.3% from a year earlier as COVID-19 impacts sharply reduced truck freight last month’, according to Bob Costello, ATA Economist. Find out more here.

General National Updates:

State of the States: Learn about any updates from the states. Find out more about each state here.

Webinar Alert! Join Matt Wagner, Vice President Sales & Marketing, in a 3 part webinar series that discusses continuous improvement within supply chain management. Whether you are considered Beginner, Intermediate, Advanced or World-Class there is always room to strive for improvement.

On Thursday, June 4 at 11:00 AM EST, Matt will discuss the outbound order flow process in the series consisting of Order Entry, Quoting & Optimization, Customer Markup, Shipment Document Creation, Load Tendering, Tracking & Visibility, Freight Bill Audit, Carrier Payment and Building the Data Warehouse. What’s the next step in your journey toward continuous improvement and how do you plan to get there? Register now!

Save the Date:

Part 2: Thursday, June 11, 2020 at 11:00 AM EST

Part 3: Thursday, June 18, 2020 at 11:00 AM EST

Please contact me directly with any questions. Our next update will be no later than Wednesday, 6/3 at 4 PM.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

5.19.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 5/19/2020 at 3 PM.

General National Updates:

FedEx Caps Shipments: FedEx Corp. has limited the number of items that Kohl’s Corp. and about two dozen other retailers can ship from certain locations, as the delivery company tries to prevent its network from being overwhelmed during the coronavirus pandemic. Find out more in the original Wall Street Journal or here.

State of the States: Learn about any updates from the states. Find out more about each state here.

Please contact us directly with any questions. Our next update will be no later than Thursday, 5/28 at 4 PM.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

5.12.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 5/12/2020 at 3 PM.

TL Rates: According to DAT, spot market rates for Van (-12.6%), Flatbed (-11.7%) and Reefer (-12.0%) dropped to their lowest levels since Sept 2016. Find out more here.

General:

Trucking Employment: According to Business Insider, approximately 88,300 truck drivers lost their jobs in April. It's the biggest single-month loss of trucking jobs on record, according to data extending back to January 1990. April wiped out all trucking employment gained during the past five years and a half years, bringing the industry back to its employment numbers in November 2014. Read more here.

Other National Updates:

Factories Close for Good: According to the Wall Street Journal (WSJ), Factory furloughs across the U.S. are becoming permanent closings, a sign of the heavy damage the coronavirus pandemic and shutdowns are exerting on the industrial economy.

Makers of dishware in North Carolina, furniture foam in Oregon and cutting boards in Michigan are among the companies closing factories in recent weeks. Caterpillar Inc. CAT -2.07% said it is considering closing plants in Germany, boat-and-motorcycle-maker Polaris Inc. PII 0.92% plans to close a plant in Syracuse, Ind., and tire maker Goodyear Tire & Rubber Co. GT -2.63% plans to close a plant in Gadsden, Ala.

Those factory shutdowns will further erode an industrial workforce that has been shrinking as a share of the overall U.S. economy for decades. While manufacturing output last year surpassed a previous peak from 2007, factory employment never returned to levels reached before the financial crisis.

Layoffs have already wiped away nearly a decade of employment gains at U.S. manufacturers. Factories added 1.4 million workers from 2010 through the end of last year, employing a total of 12.9 million people in December. The manufacturing workforce has since dropped to 11.5 million, the Bureau of Labor Statistics said Friday, including 1.3 million jobs lost in April alone, though this also includes temporary layoffs.

Manufacturers in recent years have pushed up output faster than they have expanded payrolls, in part by investing in automation. Since the pandemic took hold, capital investment by manufacturers has cratered.

The Labor Department’s survey taken in April shows record job losses for the U.S.

State of the States: Learn about any updates from the states. Ohio extended the stay-at-home order through May 29. Find out more about other states here.

Please contact us directly with any questions. Our next update will be no later than Tuesday, 5/19 at 4 PM.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

5.5.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 5/5/2020 at 3 PM.

We will begin to provide updates weekly while continuing to monitor activity proactively. If any other urgent news develops, we will communicate that information accordingly. Our next update will be Tuesday, 5/12.

TL:

Truckload Rates: Spot market truckload rates hit a four-year low in April. For dry van freight, the national average was just $1.64 per mile. Learn more about truckload rates in this article.

Other National Updates:

State of the States: Learn about any updates from the states. Ohio extended the stay-at-home order through May 29. Find out more about other states here.

Please contact us directly with any questions. Our next email update will be no later than Tuesday, 5/12 at 4 PM. Please visit our website for other updates.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

5.1.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 5/1/2020 at 3 PM.

There are few updates for today, but included is some information on driver safety and state status. Stay tuned for more transportation updates next week!

National Updates:

Masks for Drivers: The Federal Motor Carrier Safety Administration is distributing 1 million protective masks to commercial truck drivers to enhance safety during the coronavirus pandemic. Find out more here.

State of the States: Find out which states are set to reopen. Some states have communicated commitments to opening back up. Find out more about other states here.

Please contact us directly with any questions. Our next update will be no later than Tuesday, 5/5 at 4 PM.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

4.28.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 4/28/2020 at 3 PM.

Modes of Transportation:

LTL:

First quarter a ‘distant memory’: According to JOC.com, for Greg C. Gannt, president of less-than-truckload (LTL) carrier Old Dominion Freight Line (ODFL), the rapid spread of the COVID- 19 in March and the resulting stay-at-home orders and widespread business closures created a sharp rupture with the immediate past. “First quarter seems like a distant memory at this point,” Gantt said in an earnings call Thursday.

In the first quarter, ODFL’s shipments per day were down 5.1 percent year over year. By late April, however, LTL volume was down about 20 percent year over year, the company said. LTL carriers are believed to have taken a harder hit in April than their truckload competitors, both because of higher fixed operating costs and their reliance on industrial freight shippers.

“Many of our customers are currently closed,” Gantt said. “As a result, our volumes dropped off pretty significantly at the beginning of April, but they have remained fairly steady ever since. This has allowed us to quickly adjust to our new daily shipment counts.” ODFL has seen shipment weights rise even as volume drops as its freight mix shifts toward essential goods.

“You had customers that were just trying to use capacity in any way they could,” ODFL’s CFO Adam Satterfield said. “And so maybe some heavier loads came our way.” Shippers may have shifted what typically would be truckload shipments to volume LTL as truckload capacity tightened in March, or with an eye to ensuring delivery within a set time frame.

ODFL revenue dropped 0.3 percent in the first quarter to $987.4 million, while net profit dropped 0.1 percent to $133.2 million. By contrast, in April to date, the company’s revenue per day has been down about 20 percent year over year, Satterfield and Gantt told Wall Street analysts, as freight volumes tumbled down the economic equivalent of a runaway truck ramp.

That drop in LTL volume is similar in scale to that reported by other carriers and LTL brokers, including third-party logistics (3PL) provider Echo Global Logistics. The 3PL’s brokered truckload volumes were down 4 percent year over year in April, but brokered LTL shipments fell 24 percent, Echo executives said in a first-quarter earnings call last week.

TL:

Truckers prepare for long, uneven recovery: According to JOC.com, Truck capacity will become scarce again, putting pressure on truckload rates, predicts David A. Jackson, president and CEO of Knight-Swift Transportation Holdings, after the expected collapse of thousands of smaller carriers and the migration of their drivers to larger trucking companies.

Knight-Swift, which had $4.8 billion in total revenue in 2019, saw that line item drop 6.6 percent year over year in the first quarter to $1.1 billion. Trucking revenue, excluding fuel surcharges, dropped 5.1 percent. Net and operating income fell, but the company’s trucking subsidiaries had healthy profits, posting a combined adjusted operating ratio of 86.5 percent for the quarter.

The holding company is the parent of Swift Transportation, the largest stand-alone truckload carrier, as well as Knight Transportation, Barr-Nunn, and Abilene Motor Express.

Trucking companies large and small are focused on getting through the next month or two. Many companies might not make it. “It is difficult for the small truckers,” Dave Menzel, president and COO of Echo, said. “We know of truck drivers and small carriers who have just said, ‘I’m going to stay home because I can’t find freight and the rates are too low.’”

Menzel said he also has seen carriers pull drivers off the road because of low demand. Knight-Swift’s Jackson says many of them are knocking on his doors. “We’ve seen an increase in experienced drivers looking for employment at numbers we’ve not seen before,” he said. “That’s a pretty powerful indicator for us of where the small carrier is right now.”

Other National Updates:

State of the States: Find out which states are set to reopen. Some states have all communicated commitments to opening back up. Find out more about other states here.

In Ohio, Mike DeWine announced a reopening of Ohio’s economy over the next two weeks - including in health care, construction, manufacturing, offices and retail. Learn more here.

Please contact me directly with any questions. Our next email update will be no later than Friday, 5/1 at 4 PM. Please visit our website for other updates.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

4.24.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 4/24/2020 at 3 PM.

Freight Activity: According to JOC.com, Expectations that US domestic freight activity will pick up in the next few weeks remain low, as commercial vehicle research firms and freight investment advisors signal that freight volumes and truck rates continue to drop, with the COVID-19 lockdown likely to last several more weeks. With US job losses caused by the outbreak of the coronavirus disease 2019 (COVID-19) climbing past 22 million in the last four weeks, FTR Transportation Intelligence is lowering its expectations for second quarter freight activity and a 2020 recovery. ACT now forecasts active Class 8 tractor capacity to fall 4 percent over the next year. “We believe the downturn in freight is likely to drive capacity attrition, supporting stronger pricing and upside for truckload names in the 2021 timeframe,” UBS said in its note to investors.

Modes of Transportation:

LTL: According to JOC.com, Research firm ACT Research expects LTL volumes in April and May to decrease even more than TL. ACT has lowered its expectations as the complexity of restarting the US economy becomes clearer.

Old Dominion: Revenue falls as weight per shipment soars: A sharp decline in the amount of freight hauled by Old Dominion Freight Line this month has been accompanied by an unexpected shift: a big increase in the weight per shipment. More details can be found here.

TL: According to JOC.com, As of April 20, total TL volume is down 10% YoY. Dry Van and Flatbed account for nearly all of that drop, as refrigerated volumes are up due to demand for essential, grocery goods. Contract truckload volume seems to have stabilized after a precipitous drop in March and early April. Spot market volume continues to slide. As a result, rates continue to fall. Some spot market lanes have fallen as much as 25-40%.

Intermodal: According to JOC.com, ACT told investment firm UBS it expects further weakening in freight activity in the coming weeks, with a 25 percent decline in intermodal rail volumes in the second quarter. ACT also expects a sharper decline in less-than-truckload (LTL) freight than in truckload activity.

Rail:

Union Pacific expects 25% volume dip in Q2: Union Pacific Railroad executives expect volumes to drop 25% year over year (YoY) in the second quarter, according to a Thursday earnings call. Volumes in the first quarter, ending March 31, were down 7% compared to the same period last year. Find out more here.

Other National Updates:

Small business loan program: The White House and Congress have reached a deal on a new funding package that will replenish a lending program meant to aid small businesses hurt by the novel coronavirus outbreak, two administration officials confirmed Tuesday. Read more here.

$2.9B in CARES Act funding dispersed to Airlines: The U.S. Treasury Department has disbursed an initial round of financial aid to passenger airlines worth $2.9 billion, as a deal was finalized with six large carriers over terms related to payroll assistance. The six large airlines that have agreed to final terms are Allegiant Air, American Airlines, Delta Air Lines, Southwest Airlines, Spirit Airlines and United Airlines. Read more here.

In case you missed it…

Check out our recent webinar: Control What You Can Control: Supply Chain Best Practices in an Ever-changing Landscape

Visit https://www.gojarrett.com/webinar to listen now or find past webinars!

For other transportation news, check out our Q1 2020 Industry Update.

Inside you’ll find the latest on LTL, TL, Parcel, and Fuel. You can also read about Amazon's effect on the industry and disruptions caused by COVID-19. Check it out through this link.

Please contact us directly with any questions. Our next update will be no later than Tuesday, 4/28 at 4 PM. Please visit our website for other updates.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

4.21.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 4/21/2020 at 3 PM.

Modes of Transportation:

Truck Tonnage on Coronavirus Surge: Truck tonnage was up 4.3% YoY in March, but expect a very soft April. Find more information here.

Other National Updates:

Oil Industry: U.S. oil prices for the summer months deepened their sell-off Tuesday on storage concerns and evaporating demand, while President Donald Trump plans an oil-industry bailout. More information can be found here.

State of the States: Find out which states are set to reopen. Some states, such as GA, SC and TN, have all communicated commitments to opening back up. Find out more about other states here.

It’s not too late to register! Join us on Wednesday, April 22 at 11:00 AM EST as Matt Wagner and Matt Angell discuss controlling what you can control when it comes to your supply chain & COVID-19.

Register now by using this link: https://www.gojarrett.com/webinar-control-what-you-can-control

During the webinar, we will cover relevant topics including:

- Making the Right Decisions

- Identifying Hidden Savings in Inbound Freight

- Properly Quoting Freight

- Having Checks & Balances In Place

Please contact me directly with any questions. Our next update will be no later than Friday, 4/24 at 4 PM.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

4.17.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 4/17/2020 at 3:00 PM.

Modes of Transportation:

LTL:

According to the Wall Street Journal (WSJ):

- FedEx’s less-than-truckload Freight unit is furloughing “a small number” of employees because of a decline in volume. (Daily Memphian)

TL:

According to the Wall Street Journal (WSJ):

- A survey shows U.S. trucking companies are furloughing workers in larger numbers this month as business falls. (Commercial Carrier Journal)

Other National Updates:

Diesel fuel pricing: Diesel Fuel pricing continues to drop due to reduced demand, and at $2.507/gal, are now $.61 lower than this time last year. More information can be found here.

Aerospace supply chains are in a steep decline. Boeing Co. removed more than 300 jetliners from its order book in March, the WSJ’s Doug Cameron reports, as airlines adjust their fleets to projected weaker future demand in response to the coronavirus pandemic.

However, Boeing Co is resuming commercial airplane production at Puget Sound. "Approximately 27,000 people in the Puget Sound area will return to production of the 747, 767, 777 and 787 programs," the company said. Find out more information here.

Re-opening the country: President Trump has released a set of guidelines for opening the country up in three phases, ensuring that resurgence isn't occurring between each phase. The phased approach would be implemented on a statewide or county-by-county basis at the discretion of state Governors. You can find the details here.

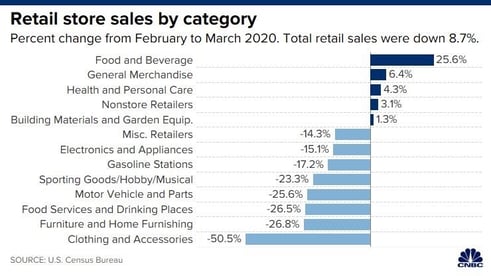

Retail Store sales percent change from February to March 2020:

We have another webinar coming your way! Tune into the conversation on Wednesday, April 22 at 11:00 AM EST as Matt Wagner and I discuss controlling what you can control when it comes to your supply chain & COVID-19. Register now by using this link: https://www.gojarrett.com/webinar-control-what-you-can-control

During the webinar, we will cover relevant topics including:

- Making the Right Decisions

- Identifying Hidden Savings in Inbound Freight

- Properly Quoting Freight

- Having Checks & Balances In Place

We hope that you will join us!

Please contact me directly with any questions. Our next email update will be no later than Tuesday, 4/21 at 4 PM. Please visit our website for other updates.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

4.14.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 4/14/2020 at 3:30 PM.

3PL:

According to Journal of Commerce (www.JOC.com), difficult times may be in the not too distant future for 3PL's who haven't developed strategic partnerships with their clients and don't have a world class technology platform. The sudden shutdown of freight-generating businesses is rippling through the third-party logistics industry, leading to layoffs and putting thousands of transportation intermediaries at risk. Most endangered are small to midsize companies without specialized niches and little technology. As volumes shrink, even larger companies face tough challenges.

The shutdown and the coronavirus disease 2019 (COVID-19) threaten not just freight capacity sourced from truckers and brokers, but the integrity of supply chains. Suppliers whose buyers are shut down are not moving goods to market, and those that are often find labor shortages attributed to the pandemic mean too few workers at warehouses or customer docks.

Jarrett is well positioned as a strategic partner to our clients, providing solutions-based services to clients in nearly all segments of our economy. In 2019, Jarrett was named to the Inc. 5000 for the 14th year, joining an exclusive list of only 6 companies to accomplish this feat. Additionally, Jarrett was awarded the Inc 5000’s ‘Best Use of Technology to Fuel Business Growth’ award, showcasing our ability to deploy world class technology in a high-touch, client focused Routing Center environment.

Modes of Transportation:

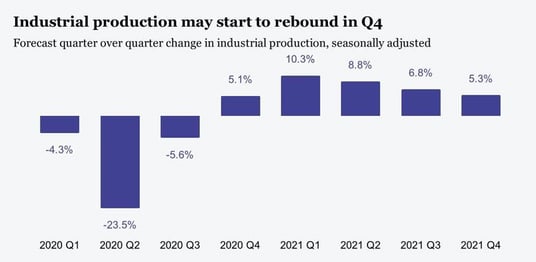

What’s next for trucking? Many economists believe the Q2 contraction, caused by COVID-19 and the associated work stoppages and slowdowns, will be substantial. A forecast can be seen below for Industrial Production that was published from the Freight Transportation Research Associates Inc. A rebound is projected, but we won’t hit 2019 production levels until 2022:

Fleets and logistics firms making tough calls: Saia, an LTL fleet, furloughed some sales staff for the week ended April 10, according to Freightwaves. Echo Global Logistics reduced about 5% of its staff, Freightwaves also reported.

More information on the above information can be found here.

Other National Updates:

India & Bangladesh extend lockdowns: India extended its nationwide lockdown Tuesday until May 3, according to the New York Times. Multiple media reports suggest Indian Prime Minister Narendra Modi may announce a plan to reopen some factories under new guidelines for operation later in the week. Bangladesh manufacturers will remain closed until April 25, according to The Daily Star. More information can be found here.

Truckers struggle to find adequate rest stops: The coronavirus is adding stress to truckers delivering essential goods throughout the U.S. as they struggle to find bathrooms and rest stops to grab a bite to eat and take a nap. Read more here.

Stay Tuned...

During an environment with so many unknowns and information changing so quickly, join Matt Angell, Vice President of Logistics Operations and Matt Wagner, Vice President of Sales & Marketing while they talk about areas shippers can focus on to improve execution within their supply chain during these challenging times.

- Making the Right Decisions

- Identifying Hidden Savings in Inbound Freight

- Properly Quoting Freight

- Having Checks & Balances In Place

Registration information coming soon!

In Case You Missed It…

Mike Jarrett participated as the keynote speaker in last week’s webinar “COVID-19’s Affect on North American Business”. Click HERE to listen as Mike provides insight on the following:

- Significant milestones business leaders have been forced to address with COVID-19

- How this pandemic has impacted the workforce and what this has meant for business leaders

- What can we anticipate in the days/weeks ahead

- Short Q&A session at the end

Please contact us directly with any questions. Our next update will be no later than Friday, 4/17 at 4 PM.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

4.10.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 4/10/2020 at 3:00 PM.

Modes of Transportation:

TL: According to the Journal of Commerce (JOC.com), “As suddenly as they rose last month, US spot market truck rates are falling in April, dragged down as shipments of everything except essential freight decrease. The trend is evident in data from DAT Solutions and in freight lanes where pricing is tracked by JOC.com. Third-party logistics providers confirm the drop, and expect it to continue.

Dry van spot rates have fallen significantly so far in April, conceding all the gains of March, according to a JOC.com analysis of pricing in a sample of roughly 200 top US freight lanes. Data from digital broker Loadsmart shows the unweighted average dry-van spot rate on these lanes fell to $1.83 per mile so far in April, after surging to $1.94 per mile in March amid panic buying.”

Intermodal: “Intermodal volume declined 15 percent year over year to 339,125 containers and trailers in the week ending March 27 (Week 13), the worst final week of a first quarter since 2013,” according to a Journal of Commerce (JOC.com) analysis of data from the Association of American Railroad and BNSF Railway. “Although BNSF's intermodal data is not yet available for the week ending April 3 (Week 14), last week's volume will be the weakest in North America since 2013 in a best-case scenario and lowest since the Great Recession of 2008–09 in a worst case scenario.

The decline in volumes is contributing to a deep financial hit to Class I railroads, which Amit Mehotra, rail industry analyst with Deutsche Bank, reckons will cost the industry some $9 billion in revenue, including intermodal and railcar business, and $4.7 billion in profits this year. He estimates volume across all commodity groups will drop 14 percent year over year in 2020 “roughly consistent with broad-based volume declines endured during the financial crisis in 2009, and significantly worse than declines observed between 2014 and 2016 [the last freight recession].”

Other National Updates:

FMCSA extends HOS emergency declaration through May 15: The Federal Motor Carrier Safety Administration has extended and expanded its emergency declaration providing regulatory relief to truck drivers who are transporting emergency supplies during the coronavirus outbreak.More information can be found here.

Please contact me directly with any questions. Our next update will be no later than Tuesday, 4/14 at 4 PM.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

4.8.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 4/8/2020 at 11:30 AM.

Modes of Transportation:

Carriers continue to emphasize that communication between shippers and receivers concerning whether or not they are open remains a priority. Good Friday is this upcoming Friday and serves as a good reminder for customers to communicate closures, so that unnecessary delivery attempts are minimized.

LTL:

LTL trucker temporarily cuts wages: According to the Journal of Commerce (JOC.com), as freight volumes plummet, caught in the undertow of the coronavirus disease 2019 (COVID-19) pandemic, Northeast regional less-than-truckload (LTL) carrier A. Duie Pyle is temporarily furloughing employees and reducing wages to weather the economic storm. Pyle is not the only LTL trucking company feeling the pain.

The LTL industry, overall, is more dependent than truckload companies on industrial goods that today are considered non-essential. E-commerce is beginning to change that, but perhaps not quickly enough. Other companies are making pay cuts as well, said Satish Jindel, president of SJ Consulting Group, noting that many of the shipper customers have furloughed employees. LTL carriers are seeing deep reductions in freight volume as non-essential businesses are shuttered.

Parcel:

Amazon halts delivery service: Shares of FedEx Corp. surged 5.0% and of United Parcel Service Inc. rallied 4.2% in premarket trading Wednesday, after The Wall Street Journal reported that Amazon.com Inc. was halting a delivery service known as Amazon Shipping that directly competes with the package delivery services. More details can be found here.

INTL:

March US imports slammed by COVID-19 effects: According to the Journal of Commerce (JOC.com), US imports from Asia in March fell to the lowest level in seven years as retailers and manufacturers pulled back on orders of nonessential merchandise and inputs amid plunging consumer demand and factory closures caused by the coronavirus disease 2019 (COVID-19). Global Port Tracker, which is published monthly by the National Retail Federation (NRF) and Hackett Associates, projected Tuesday that total US imports in the first half of 2020 will decline 15.1 percent from the same period last year.

Year-over-year (y/y) monthly declines will likely continue into the second half of 2020, it projected. “The largest drop is forecast for the first half of this year, but with uncertainty about the length of the lockdown and extent of the pandemic, the second half may not be in better shape,” said Ben Hackett, founder of Hackett Associates.

Other National Updates:

Transportation bottlenecks snarl inputs to the food supply chain: The global food system's greatest challenge is not supply, but behavior up and downstream. Food supply chains are running at full tilt downstream. But upstream, the global raw materials supply chain is suffering from bottlenecks and diversions caused by varied national responses to the COVID-19 global pandemic. More information can be found here.

Don’t forget to register for our webinar: COVID-19’s Impact on North American Business.

Sign up now to hear from Mike Jarrett, an EY Entrepreneur of the Year, and Matt Wagner! Both executives are experts on leadership and have contributed to Jarrett's 14-time appearance on the Inc. 5000 list.

There are only a few seats remaining, click here to save your spot.

Together, Mike & Matt will cover:

- Significant milestones business leaders addressed in the last 30 days

- How COVID-19 has impacted the workforce and business leaders

- Forecasting long-term implications of COVID-19 on businesses

Please contact us directly with any questions. Our next update will be no later than Friday, 4/10 at 4 PM.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

4.6.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 4/6/2020 at 12:00 PM.

Modes of Transportation:

LTL:

Cleveland Research Company: While LTL volumes have likely continued to trend lower Y/Y, CRC work indicates carriers continue to pursue steady rate increases in contract (+2-4% Y/Y) as cadence of selective discounting remains steady versus pre-COVID levels.

- LTL carriers are lowering 2020 tonnage expectations from +2-3% to down 0-2% Y/Y as a result of COVID-19. CRC is hearing 1Q volumes have declined 3-6%.

- CRC’s research indicates Old Dominion Freight Lines and other LTL carriers remain price disciplined and securing 2- 4% rate increases (vs +4-6% in 2019); we continue to hear a steady cadence of isolated discounting from certain LTL carriers (similar to prior 6-9 months) selectively lowering price (0-2%) to grow market share.

TL:

Truckers tighten belts as shutdowns spread: According to JOC.com, US trucking companies are bracing for a slowdown even as insatiable demand for essential goods elevates freight volumes. They’re expecting the surging demand for toilet paper, food, and household goods buoying them now will eventually ebb, although it’s not clear when. US trucking companies are bracing for a slowdown even as insatiable demand for essential goods elevates freight volumes. They’re expecting the surging demand for toilet paper, food, and household goods buoying them now will eventually ebb, although it’s not clear when.

Coronavirus mitigation sparks truck rate spikes in ‘high-risk’ areas: According to JOC.com, trucking rates are climbing across the United States as demand to haul essential goods skyrockets, more than outpacing any decline in freight from shippers whose customers have shut down. But transportation economists warn the market could cool soon if non-essential retailers such as Macy’s, Bed Bath and Beyond, Havertys, and others remain closed and cancel existing orders from US suppliers or Asian factories.

Cleveland Research Company: Research indicates an incremental softening in truckload volumes over the past week from COVID peak (1-2 weeks ago) as general freight weakness offsets non-food and beverage demand. Forward-looking volume forecasts remain limited, but expectations have been lowered vs 30 days ago. Spot market TL prices appear to be moderating vs 1-2 weeks ago. CRC expects TL contract rates to be down at least 3-5% Y/Y in 2020 contracts.

- Shippers appear to be seeing minimal rejections on contract rates (first load tender acceptance above 90-95% target), with 2020 contracts seeing rates down 3-5% Y/Y (vs 2019 down 5-15%).

- CRC has seen moderation in spot market demand (and rates) vs peak 1-2 weeks ago due to unplanned volume and abnormal patterns, with retailers asking carriers to deliver straight to their stores (rather than distribution centers); food and beverage volumes have spiked 50-100% in early March, while suppliers of the restaurant industry are likely down 50-75%. We are seeing freight volumes from retail and industrial markets slow over the past 1-2 weeks.

- Spot market rates appear to be stabilizing W/W but remain higher M/M and Y/Y as demand levels off.

- TL carriers are still seeing instances of surge requests to replenish essential freight vs 30 days ago, but at moderating levels vs 2 weeks ago (when initial government restrictions and social-distancing directives began going into effect).

- Flatbed TL volumes are likely declining 10%+ and CRC is hearing similar volume expectations through April.

Other National Updates:

Masks flown into America on New England Patriots Plane: The Massachusetts governor struck a deal for N95 masks from China, but he needed a way to transport them. The New England Patriots plane ended up making the delivery. Read more about this creative solution here.

A special Thank You to our friends at Imery’s Tact in Three Forks, MT. A driver picking up there Friday was greeted with a letter, signed by dozens of employees, thanking him for being part of one of the most essential of all industries: The transportation industry. Without the men and women who bring us our raw materials and haul our finished products to our customers, our economy grinds to a halt.

Don’t forget to register for our upcoming webinar: COVID-19’s Impact on North American Businesses. The webinar will feature our President and CEO, Mike Jarrett, as well as the VP of Sales and Marketing, Matt Wagner. Together, they will discuss how businesses have been affected in the past 30 days as well as what lies ahead. Stay tuned for more information on how to save your seat!

Please contact us directly with any questions. Our next update will be no later than Wednesday, 4/8 at 4 PM.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

4.2.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 4/2/2020 at 3:00 PM.

Modes of Transportation:

LTL: Several carriers are beginning to furlough employees in various areas within their organizations as overall business levels have recently dropped.

Significant Carrier Announcements:

ArchBest: Logistics provider ArcBest Corp. (NASDAQ: ARCB) announced that it has drawn down its revolving credit facility in response to the uncertainty facing freight markets amid the coronavirus outbreak. More information can be found here.

Parcel: The small parcel market has seen a dramatic change in a short period of time, with a significant spike in business to consumer activity.

Other National Updates:

Canadian Border: Regarding perceived or potential restrictions moving across the Canadian border, we have this reassurance from Clint Ellis, President of Priority Brokerage, a Canadian customs brokerage firm, “‘There are no restrictions on the free flow of commercial traffic across the US/Canadian border due to COVID-19.”

You can contact Clint at info@prioritybrokerage.ca or 905-212-9901. For more information, you can visit their website: www.prioritybrokerage.ca

Impossible Dock Scheduling: Impossible Foods has implemented dock scheduling software to eliminate carrier wait times, reduce detention costs and provide much enhanced visibility to what is coming in, what is going out and when. Additionally, it makes drivers happy. This makes companies like Impossible a ‘shipper of choice’, allowing them to grab more capacity when it’s otherwise scarce. Jarrett has implemented similar software at many of its clients’ locations through North America with great success. Learn more about Impossible’ s story here.

The CARES Act: The CARES Act was recently passed. This act proposes setting up a task force to evaluate American medical supply chains and develop a plan to address their current and potential vulnerabilities using the following strategies:

- Promote supply chain redundancy and contingency planning;

- Encourage domestic manufacturing

- Improve supply chain information gaps

- Improve planning considerations for medical product supply chain capacity during public health emergencies

- Promote the accessibility of such drugs and devices.

More information on how the CARES Act will affect supply chains can be found here.

State by state closures: See what states and cities have told residents to stay home through this link.

Please contact us directly with any questions. Our next update will be no later than Monday, 4/6 at 4 PM. Please visit our website for other updates.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

3.31.2020

There are no significant updates in the transportation segment at this time. We will begin to provide updates at a cadence of every other day while continuing to monitor activity proactively. If any other urgent news develops, we will communicate that information accordingly.

Social distancing extension: During his press conference Sunday, March 29, Trump extended federal social distancing guidelines to April 30. More information can be found here.

Please contact us directly with any questions. Our next update will be no later than Thursday, 4/2 at 7 PM.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

3.30.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 3/30/2020 at 2:30 PM.

Modes of Transportation:

LTL: National LTL carriers have little to no restrictions in their ability to operate within the US and across the northern and southern borders. Carriers continue to work diligently to ensure that both shipper and consignee on all shipments are open to ensure the free flow of freight through their networks.

TL:

Market uncertainty lifts US trucking instant quotes: According to JOC.com, “Digital brokers are navigating a topsy-turvy freight market, which makes it very difficult to anticipate how much it will cost to purchase a truck in two or three weeks.

Any semblance of predictability in the US surface freight market over the next three weeks is so scant among freight brokers that they’re quoting rates more than 15 percent higher than prior to the coronavirus disease 2019 (COVID-19) spreading to the US.

Four truck brokers, all of which provide instant digital quotes, have raised rates through March 25 compared with February, according to a JOC.com analysis of 115 US lanes. The review includes markets such as Los Angeles, Seattle, and Elizabeth, New Jersey, all of which have been hit hard by the COVID-19 outbreak.

Since there is no historical precedent on which to rely, the proper strategy is to lean on real-time data to make forecasts, according to three of the four digital brokers that spoke to JOC.com. If the real-time data is unclear, however, then it’s more difficult to make a 14- or 21-day forecast.

One fact isn’t in doubt: truckload rates are higher than a month ago in nearly all US markets. Inbound rates into New York are up 26 cents sequentially in March, according to a JOC.com analysis. Inbound rates to Connecticut, Georgia, New Jersey, Ohio, and Pennsylvania are up 25, 24, 23, 22, and 21 cents, respectively. Rates are up 18 cents into California and Washington state this month.”

Creative Solutions:

- US Foods, a restaurant supplier with its own trucks, has fewer restaurants to supply. So, it’s hauling grocery freight for C&S, a large NE grocer. More information can be found here.

- Kenan Advantage Group, North America’s largest tank truck transporter, began using its own power units to haul Walmart trailers to assist with Walmart’s increased demand.

Other National Updates:

State by state closures: See what states and cities have told residents to stay home through this link.

Please contact me directly with any questions. Our next email update will be no later than Tuesday, 3/31, at 7 PM. Please visit our website for other updates.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

3.27.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 3/27/2020 at 3 PM.

Modes of Transportation:

LTL: Carriers are continuing to operate their business and making adjustments as needed. We will continue to communicate significant announcements as they are confirmed along with any carrier adjustments within these updates.

Significant Carrier Announcements:

UPS Freight: Effective today, March 27, UPS Freight is temporarily suspending the Guaranteed Day and Guaranteed by Noon service offerings. Their Urgent Services department will continue to offer guaranteed services with delivery as promised or no charge.

Central Freight Lines purchases Volunteer: Central Freight executed an agreement to acquire most of Volunteer Express, Inc.’s business. Effective April 5, Volunteer Express’ customers will join the Central Freight Lines family. The goal of the acquisition is to strengthen their internal process and expand their footprint.

TL:

Mexico surges as US-China supply chains suffer : According to JOC.com, “A 26-cent increase in the average outbound per-mile rate from Laredo, Texas, and a 28-cent per-mile spike in McAllen, Texas, point to increased demand for imports from Mexico in March, after China-US supply chains snapped in February. Outbound rates from Memphis and Chattanooga, Tennessee, were up 25 and 21 cents per mile, respectively, the JOC.com analysis revealed.”

Air:

FedEx: Fred Smith, CEO of FedEx, was interviewed on CBS and gave a positive update on the status of the company:

- Passenger airlines, which carry a large amount of airfreight, are by and large shut down. A considerable amount of that volume has been shifted to FedEx.

- China is re-opening. After having zero flights there early this month, FedEx had 246 last week.

American Airlines: AA is flying it’s first cargo-only flights since 1984. The first flight lane DFW to Frankfurt, Germany in 777-300’s carrying more than 100,000 pounds of cargo.

- Flights contain telecommunications equipment, electronics, e-commerce items and medical supplies.

- Delta, Korean Air and Qantas are also shifting to cargo flights as passenger volume levels have plummeted.

More information on both FedEx and American Airlines can be found here.

Other National Updates:

Identify changes and closures of individual states: This link contains constant updates of closures and changes in every state and could be helpful for finding information when shipping to customers: https://ogletree.com/covid-19-closure-orders/

Please contact us directly with any questions. Our next update will be no later than Monday, 3/30, at 7 PM.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

3.27.2020

Our country continues to try and balance public health and safety surrounding COVID-19. We invite you to watch this video to learn more about how Jarrett proactively and successfully mobilized all employees that are able to operate at a work-from-home environment.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

3.26.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 3/26/2020 at 5:30 PM.

Modes of Transportation:

Update: US trucks shippers capitalizing on HOS relief: According to JOC.com, “As truck drivers rush to deliver essential goods during the coronavirus disease 2019 (COVID-19) pandemic, US shippers are taking advantage of extended driver hours to speed replenishment. They’re putting more people on docks, ensuring they’ve purchased the right amount of goods, and even creating forms to help truckers hauling their loads verify they and their shipments are exempt from US hours-of-service (HOS) rules.

The first-ever nationwide HOS exemption is meant to put some flexibility back into a US transportation network that is limited by the daily clock governing trucker working hours, which allow 11 hours of daily driving time and 14 hours of on-duty time. The exemption allows truckers to exceed those limits, as long as they take a 10-hour break afterward.

Drivers are apparently using the HOS exemption, but there’s no way to publicly track how many are working longer hours to get essential goods to destinations. Truckers are traveling faster through typically congested urban areas, however, thanks to a reduction in everyday commuter traffic, according to a new report from the American Transportation Research Institute.”

LTL: Carriers are continuing to operate their business and look for freight while making adjustments as needed. We will continue to communicate significant announcements as they are confirmed along with any carrier adjustments within these updates.

- Most national LTL carriers are seeing a significant drop in volume. Some are reporting as much as a 15-20% overall drop in volume late this week.

Significant Carrier Announcements:

- FedEx Freight: FedEx Freight will continue to accept and deliver freight in limited service markets as outlined by state and local governments, as well as to any customer (in any market) that is open for business.

- NEW: Technology: U.S./ CAN: FedEx Freight Operations launched new technology for the U.S. and CAN that prompts both drivers and billing clerks to confirm a shipment destined to a restricted area is going to a business that is confirmed to be open.

- The shipper must confirm that the business is open for delivery before tendering the shipment. The new functionality launched in both driver handhelds and in the freight billing system. Field Operations was notified of this change on Sunday, March 22.

- Old Dominion: Every Old Dominion Service Center and every Old Dominion Shop is 100% fully operational. They have increased their inventory of high use parts by 10%-20% in their shops. This was done because some suppliers have been downsizing their operations and they did not want to get caught without parts to repair equipment.

TL:

Rates rising in ‘topsy-turvy’ US trucking market: According to JOC.com, average spot dry-van rates increased 6.1 percent. An analysis shows inbound spot rates are up more than 10 cents into WA and CA markets. Inbound truck spot rates are up 19 cents in CA and WA, 12 cents in PA and 10 cents in IN and FL.

Other National Updates:

Oil Excess: The world will run out of places to store oil in as little as three months, according to an industry consultant. Inventories are expected to increase by 1.8 billion gallons. More information can be found here.

Looking Ahead:

NY/NJ prepares for potential cargo backlog: According to JOC.com, “The Port of New York and New Jersey is moving to head off a cargo backlog in marine terminals and warehouses in April and May as Chinese import volumes rebound from the trough created by blank sailings linked to China’s recent production slowdown.

The Port Authority of New York and New Jersey (PANYNJ) expects cargo volumes to rise 25 percent later this spring from present levels as imports from China begin to recover after the reopening of Chinese factories that had been shut in February due to the coronavirus disease 2019 (COVID-19).”

Please contact us directly with any questions. Our next update will be no later than Friday, 3/27, at 7 PM.

If you are not currently a JLS customer, and need assistance routing a shipment, contact us and we will be happy to assist you.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

3.25.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 3/25/2020 at 4:00 PM.

Modes of Transportation:

LTL: Carriers are continuing to operate their business and look for freight while making adjustments as needed. We will continue to communicate significant announcements as they are confirmed along with any carrier adjustments within these updates.

- Several national carriers outsource their tracking and billing overseas. With an effective shutdown now in place for those areas, carriers are reporting that pro level information may not be available for up to 36 hours after ship date via call or email.

- However, all electronic connectivity between Jarrett Logistics and our carrier partners remains in tact and continues to allow for proactive tracking and communication.

TL: The COVID-19 response has “disrupted freight flows and boosted rates.” See more information and updates, according to DAT, here.

Parcel: The impact of COVID-19 is causing local, state and national governments to issue travel restrictions which in turn effects parcel delivery.

- UPS: Effective March 24, 2020 and until further notice, the UPS Service Guarantee is suspended for all U.S. origin shipments (U.S. Domestic and International) at any service level. More information can be found here.

Other National Updates:

Canadian Border: No new or additional information is required at the border at this point. Many carriers are letting us know that documentation might be a requirement for travel in the near future for both domestic and cross border business. This could apply for all essential businesses not just including the carriers. We will keep you updated on the requirements as quickly as possible.

State by State Closures: CT, MA, HI, IN, MI, and OR have issued stay-at-home-orders, joining the list of states already affected: CA, DE, IL, LA, NJ, NM, NV, NY, OH, PA, WA, WI & WV.

More details on each state can be found here:

Please contact us directly with any questions. Our next update will be no later than Thursday, 3/26, at 7 PM.

*The information above is subject to change with developing news and updates. We are providing a recap of the most up-to-date information as possible. Each update contains information confirmed by credible sources and does not include inaccurate or speculated news.

3.24.2020

We have the following updates within various areas of the transportation segment surrounding COVID-19 as of 3/24/2020 at 3:30 PM.

Modes of Transportation: It appears, with few exceptions, that the transportation industry might be the least restricted segment of our economy. Trucks can move freely about the country, even in restricted areas. The only restrictions seem to be whether the pick up and delivery locations are open and operating as normal.

LTL: Carriers are continuing to operate their business and look for freight while making adjustments as needed. We will continue to communicate significant announcements as they are confirmed along with any carrier adjustments within these updates.

Significant Carrier Announcements:

Beaver Express: A regional delivery agent servicing TX, OK and KS as a partner to multiple large LTL carriers, yesterday announced they are shutting down operations permanently effective March 26, 2020.

A note from the President of Beaver Express, highlighting an arrangement with ODFL, can be found here.

More information can be found here.

YRCW: YRCW is operating as normal, but note they are looking at key essential industries to make sure the freight is moving to places such as grocery stores, medical industries etc. They ask you to help support those as well and ask them to put a guarantee or time critical option on these shipments to expedite.

- Open/Closed Business: Need to know what businesses are closed in order not to deliver freight, but it is also important to help avoid storage and redelivery charges for your customers if they try to move the freight as these will be applied

- Canada Cross Border: YCRW’s border manager has verified this will not impact drivers moving freight across the border north or south.

- Mexico Services are up and operational as well. YCRW implemented new rate structures as of 3-20-20.

- Residential Direct and Project Management Resources: YRCW is seeing an increase around these services due to businesses closing and customers needing to have items shipped to their homes or stores that are essential needing immediate projects/end caps/displays refilled. Please reach out to your JLS account team for more information.

TL: The COVID-19 response has “disrupted freight flows and boosted rates.” See more information and updates, according to DAT, here.